Key GST Update - Input Service Distributor (ISD) Mechanism

- S M S J & Associates

- Apr 1

- 3 min read

ISD or an Input Service Distributor is a type of taxpayer under GST who needs to distribute the GST input tax credits that pertain to its GSTIN to its units or branches having different GSTIN but registered under the same PAN. From 1st April, 2025, it is mandatory to get registered under GST as an ISD. The ISD mechanism is only meant for distributing the common Input Tax Credit pertaining to input services.

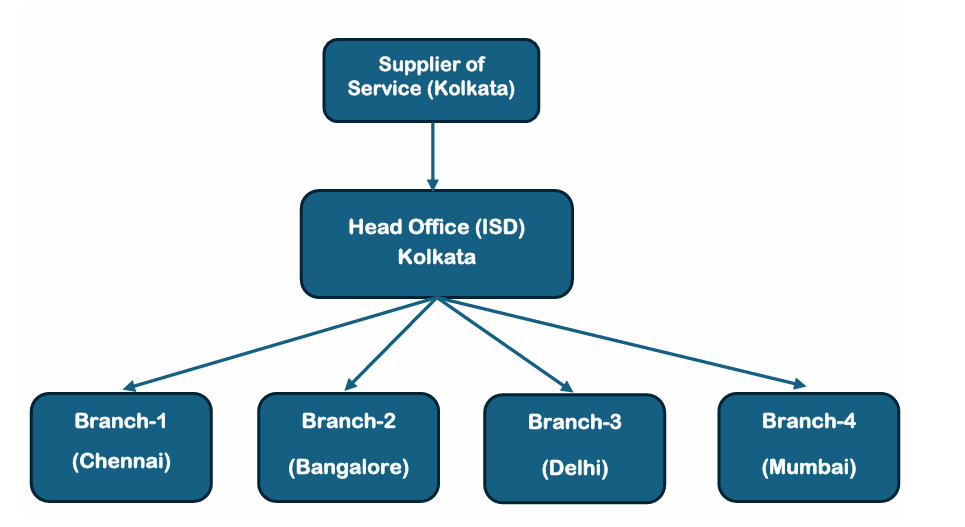

For e.g. The Corporate office of ABC Ltd. is in Kolkata, with its business locations for selling and servicing of goods at Chennai, Bangalore, Mumbai and Delhi. The company has purchased Software license and maintenance services from a vendor at Kolkata; the same service is used at all the locations, but invoices for these services (indicating CGST and SGST) are received at the Corporate Office in Kolkata. Since the software is used at all four locations, the input tax credit of the entire services cannot be claimed as ITC at Kolkata, it has to be distributed to all four locations. For that reason, the Kolkata Corporate office has to act as the ISD to distribute the credit.

The Head Office, which intends to act as ISD, shall obtain a separate registration u/s 24 of the CGST Act, by applying in Form GST REG-01 (Turnover threshold is not applicable for ISD registration)

Key Points:

• Mandatory ISD Registration: Entities receiving invoices for input services utilized across various branches must obtain separate ISD registration. This ensures the proper distribution of ITC to respective branches.

• Scope of ISD: The ISD mechanism applies exclusively to input services and does not extend to inputs or capital goods.

• Registration Process:

o Existing Registrations: Entities already registered under GST can apply for ISD registration without cancelling their current registration.

• ITC Distribution:

o Exclusive Services: ITC for services used exclusively by a particular branch should be allocated solely to that branch.

o Common Services: For services utilized across multiple branches, ITC distribution is based on the turnover of each branch during the relevant period. The formula is:

Where:

▪ C1 = ITC for the specific branch

▪ t1 = Turnover of the branch during the relevant period

▪ T = Aggregate turnover of all branches during the relevant period

▪ C = Total ITC to be distributed

• Distribution Method:

o Same State Branches: Distribute ITC as Central GST (CGST) and State GST (SGST).

o Inter-State Branches: Distribute ITC as Integrated GST (IGST).

• Compliance Requirements:

o ISD Invoice: Issue an ISD invoice detailing the ITC distribution as per Rule 54(1) of the CGST Rules.

o Monthly Filing: Submit Form GSTR-6 by the 13th of the following month, reporting the distributed ITC.

o Record Maintenance: Maintain detailed records of received invoices and distributed ITC.

• Handling Debit and Credit Notes:

o Debit Notes: If a supplier issues a debit note, the additional ITC should be distributed to the relevant branches using an ISD invoice.

o Credit Notes: Upon receiving a credit note from a supplier, issue a corresponding ISD credit note to adjust the distributed ITC. If the credit note amount exceeds the ITC previously distributed, the branch must add the difference to its output tax liability.

• Ineligible ITC: ISDs must also distribute ineligible ITC, and it is the responsibility of the recipient branches to ensure they do not claim such credits.

• Penalties for Non-Compliance: Failure to adhere to the ISD provisions may result in denial of ITC claims and a minimum penalty of ₹10,000.

Conclusion: The mandatory ISD registration, effective April 1, 2025, aims to streamline the distribution of ITC for input services across businesses with multiple GST registrations under the same PAN. Entities must ensure compliance with these provisions to facilitate accurate ITC allocation and avoid potential penalties.

Comments